Profit margins among clothing retailers don’t vary that much – at the outside, between 5% and 25%. The vast majority are 10%-20%.

I mention this because I’m constantly surprised by consumers’ ideas of how brands are ‘ripping them off’. The fact is, the first 20% of the price you or I pay goes to government (in the UK – VAT), the next 10%-20% goes to the brand as profit, and the remainder is costs.

There seems to be a strange idea among consumers that brands just charge ‘whatever they can get away with’. That luxury brands in particular charge exorbitant prices and reap huge profits as a result.

Luxury brands certainly have higher margins. One of the reasons the industry is so attractive is that margins of 18%-25% are both achievable and sustainable (the latter being by far the most important, as many new launches have discovered in recent years).

But 20% isn’t that high. Last week, commenting on a comparison between some £200 boots and a £1000 pair on this site, a friend commented that ‘the latter is probably mostly profit anyway’. No one has 80% profit margins. In fact, given that production costs (including the manufacturer’s profit) are usually in the range of 25%-30%, the £1000 boots could cost £300 just to be made.

The sensible thing to focus on is costs – the bit between the profit and the production. Luxury brands may spend a large chunk of that on advertising and marketing; a chunk more on store design and branding; and another slice on catwalk shows. Paying for that is the only way in which you are being ‘ripped off’.

As we saw in our analysis of Savile Row costs, a lot more is spent on making a bespoke suit than in most clothing production (at least twice as much). But the difference between a tailor and a luxury brand is far more marked in these marketing and advertising costs. A tailor’s may be zero; a brand’s may be more than anything else.

So if you’re shopping in the sales over the next few days, be assured that once you have a 30% discount, the brand is making no money off your purchase (margin plus the reduction in VAT). It’s the catwalk models and full-page ads you’re paying for now.

–

P.S.

– The brands are of course recovering costs, which is why they have the sales. If they don’t sell the stock (more of a pressure in a seasonal business), they make a bigger loss.

– The profit is more complicated if a brand is not selling through its own retail, but it’s hardly worth getting into that.

Coming a bit late to the party but I have some insights to share. I looked at Brunello Cucinelli (BC) for luxury retail margins. I chose the brand because, like a tailor, it offers classic styles and focus on luxurious materials, and because I like the brand. I have crunched the public data and calculated the following cost breakdown:

For a 2,500 EUR ready-to-wear blazer (= 100%)

– 550 EUR of production costs (22%), mostly labor (330 EUR, 13%) and raw materials (150 EUR, 6%)

– 330 EUR of indirect labour (13%), which include sales staff, management and admin

– 300 EUR of sales costs (12%), which include store rent and advertising and commercial events (e.g. catalogs, Pitti, online ads)

– 90 EUR of administrative costs (3%), such as utilities, maintenance, insurance…

– 100 EUR of other operating costs (4%), such as inventory markdowns

– 730 EUR of net profit (29%)

– 400 EUR of VAT (16%)

Some insights:

– BC spend about 22% of an item’s full price on manufacturing, which is just okay.

– The sales and personal costs are unsurprisingly very high, reflecting prime retail locations, well-staffed boutiques, brand building effort and a fat organization (more than 500 executives and managers!). Notably marketing spend is only 6% of revenues, which is quite low. The boutique remains the main investment area, as physical stores still drive 95% of sales

– The net profit at full price is very high at about 30%, which is in line with the brand’s reputation of being overpriced. Even at realized price (after taking into account BC’s average discount), the net profit is still at 18%. This is how much you pay «for the brand». Most of it is reinvested though.

Note that these costs are not directly comparable to that of a bespoke tailor, because BC offers discounts during sale periods to clear their inventory. Therefore they «bake in» the discount into the SRP. Tailors do not need to do that as they manufacture on-demand.

Notes and assumptions for the nerds:

1. All numbers come from Brunello Cucinelli’s 2020 Annual Report. Despite 2020 being an exceptional year, it did not impact BC’s activity significantly.

2. BC sell to end customers via about 140 own stores and corners, and wholesale through about 500 multi-brand stores. The reported revenue is about 1:1. To calculate costs and margins with regards to SRP, I have assumed a 80% price realization in retail (meaning 20% discount off SRP on average) and 45% average gross margin for wholesale. This is based on my experience in retail.

3. I have assumed identical margins across all products, despite accessories and lower priced items (t-shirts, active wear) having probably higher margins than classic items.

4. I have assumed 20% VAT rate.

5. I can be off by +/-10%.

Amazing, thank you Adrian!

Could you explain the difference between inventory markdowns and the average discount you’ve added after the main calculation?

Thanks

You’re welcome Simon, happy to contribute.

Average discount is the average markdown BC is extending to clear their seasonal inventory. I have assumed that they sell 60% of their collection at full price, 30% at 40% off during their end-of-season sale, and 10% at 70% off through clearance/liquidation channels. This gives you an average markdown of about 20%.

Inventory markdowns refer to write-downs of aging inventory. Companies typically do this to acknowledge the fact that they may not be able to sell some of their oldest inventory. It’s not a cash expense but it needs to be reflected as a loss. Interestingly in 2020 BC exceptionally wrote down 31M EUR of inventory in prevision for donating unsold inventory to the needy through a multi-year program called “Brunello Cucinelli for Humanity”. Nobler than burning down unsold inventory!

Great, thank you Adrian

Interesting post Simon. I just wondered if you had any news about sales amongst your advertisers and other favoured makers? I know ET are having a ‘Winter Promo’ at the moment and can highly recommend them – any ‘inside info’ you can give us on any of the rest?

Read this:

Despite expanding into new markets, the luxury-retail business has been relying on price increases to drive sales. Now, even the very wealthy are nearing the limits of what they are willing to spend.

In the past five years, the price of a Chanel quilted handbag has increased 70% to $4,900. Cartier’s Trinity gold bracelet now sells for $16,300, 48% more than in 2009. And the price of Piaget’s ultrathin Altiplano watch is now $19,000, up $6,000 from 2011.

Such increases for some of the world’s most expensive indulgences far outpace inflation and contrast with the middle and lower end of the retail market, where even small increases can turn off shoppers.

At the high end of the market, a higher price can add to a product’s allure, according to one economic theory. But the practice is seen by critics as a flimsy platform on which to build sales growth, one that already could be reaching its limit and might prove precarious if the economy sours.

Spending on luxury apparel, leather goods, watches, jewelry and cosmetics reached $390 billion last year, according to Boston Consulting Group. But growth is starting to slow from its postrecession pace. Sales of such items rose 7% last year, down from the 11% annual rate in 2010 through 2012, according to the firm. BCG forecast that sales growth would hover around 6% for the next few years.

A crackdown by China on giving gifts to officials has caused much of the slowdown.

But there are also signs that price increases are starting to wear thin with Western customers amid heightened competition from more-affordable brands.

“Luxury brands are at risk of losing customers who cannot or do not want to pay more,” said Claudio D’Arpizio, a partner with consulting firm Bain & Co.

Connie Oclassen of Mill Valley, Calif., said she couldn’t buy as many pairs of Jimmy Choo flats as she used to, since prices climbed to $650 a pair from $495. In the past she would buy four or five pair a year. This year, the retired marketing executive will limit herself to three.

“Prices have gotten really crazy,” she said as she browsed at New York’s Henri Bendel recently.

Sales at Gucci, which is owned by France’s Kering SA, fell 2.1% last year. And British handbag maker Mulberry Group PLC said that lower-than-expected sales last year would decrease profit substantially. Mulberry’s chief executive said more-affordable brands, such as those from Hong Kong’s Michael Kors Holdings Ltd., had siphoned off customers.

LVMH Moët Hennessy Louis Vuitton SA said sales growth for fashion and leather goods slowed to 5% last year from 7% the year before, excluding the effects of acquisitions and currency movements. But the French company said it increased prices on its Vuitton products around 3% to 4.5% last year without an impact on its business.

“The client base is used to that type of price increase,” Chief Financial Officer Jean-Jacques Guiony said. Vuitton raised the price of a monogrammed Speedy bag in the U.S. by 15% last year to $910. That made it 32% more expensive than in 2009.

The higher prices are masking weaker growth in volume. “Companies are selling fewer units,” said Luca Solca, an analyst with Exane BNP Paribas.

An economic theory holds that for certain goods, higher prices increase desirability and drive sales, rather than suppress demand as they would for ordinary products. Economists refer to such luxury products as Veblen goods, named for American economist Thorstein Veblen, who described the phenomenon.

Higher prices didn’t dissuade Brooke Palmer, a public-relations director from Tampa, Fla., who shopped for shoes on a recent afternoon at Saks Fifth Avenue in Manhattan. Footwear is an investment, she said. And she raved about her first pair of Christian Louboutin shoes—red strappy sandals she bought 10 years ago and still wears.

“I could buy cheaper shoes, but they wouldn’t last,” Ms. Palmer said. “And they wouldn’t make my feet happy.”

The high-price strategy carries risks. Luxury brands pushed through steep increases before the recession only to have sales plunge when the crisis hit and the stock market tumbled, prompting even well-heeled consumers to slash spending.

One reason ultraluxury brands are raising prices is to distinguish their products from entry-level luxury goods that are fast picking up market share.

“The more Tory Burches and Michael Kors there are, the more the Chanels and Louis Vuittons will try to price up,” said Milton Pedraza, the chief executive of the Luxury Institute, a research and consulting firm.

The unintended consequence could be that the luxury brands drive even more customers toward less-expensive rivals.

High-end brands said the price increases are necessary to maintain quality and offset the rising costs of production.

“We are no different from other luxury brands in regularly adjusting our prices as our models, production costs, raw materials and exchange rates change,” a Chanel spokeswoman said.

Wage and material costs have increased. Wages in China have risen 62% since 2007. And the price of native steer hides, a benchmark for leather, has increased about 17% over that period, while the price of gold has more than doubled, according to FactSet and SIX Financial Information.

But rising costs don’t account for all of the increases, industry executives said. The U.S. price of a basket of luxury goods tracked by market-research firm Euromonitor International rose 13% last year, while the consumer-price index increased just 1.5%.

Andrea Ciccoli, the founder of Level Group, which operates e-commerce sites for brands such as Stuart Weitzman and Galliano, said higher leather and gold prices should translate into price increases of no more than a few percentage points.

In Europe and the U.S., brands have pushed prices higher in part to capture more money from Chinese tourists who buy luxury goods abroad to avoid tariffs that can add 40% to prices at home.

The brands also have a rising supply of wealthy people to cater to. Credit Suisse estimated 1.8 million people joined the ranks of the world’s millionaires last year.

But even for those who can afford it, higher prices are starting to bite.

Jamie Moore, a homemaker in Cleveland, Tenn., said that on her annual shopping sojourn to New York, she usually splurged on a Prada handbag, for which even a basic nylon model can cost $1,230. Not this year.

“The prices have gotten so expensive that I’m not buying one,” she said.

Thanks. Prices have certainly gone up steadily among luxury brands, and some are increasing their margins slightly. But they are also spending a lot more on promotion and new stores, particularly in Asia

You wrote more than the webpage 🙂

When a product is made to the highest standards by crafstmen in the UK you may have a point. When brands maintain their high prices but outsource production to China to be made by children, the motivation is purely profit.

Speculating on people’s personal motivation doesn’t really get anywhere.

Driving down costs with production is certainly something I’d disapprove of, but the fact remains that net profit margins don’t vary that much. Actual production is also a small proportion of overall cost, as these numbers hopefully make clear.

Simon, although I acknowledge the general percentages that you have outlined above, I personally think that the price of goods in the luxury sector have become excessive in some areas.

A small Chanel/Dior handbag costs almost as much as a Savile Row suit and is made in a fraction of the time (in a factory). I’d love to see a breakdown of such a bag’s costs.

If you look at a bench-made J.M. Weston or Gaziano & Girling pair of shoes, the quality of their materials and manufacturing is comparable to the designer bag. Their shoes cost approximately a quarter of the price of the bag. I doubt they’re making a loss!

Obviously, under-pricing can also destroy a designer brand’s exclusivity (as with Michael Kors’ cheaper bags). If a brand desires glamour and exclusivity, it surely cannot sell cheap products under the banner of luxury? I don’t begrudge any price-tag, provided it reflects the materials and work involved. However, too many brands are guilty of making cheap goods and inflating the price in the name of profit.

I remember once seeing a Marc Jacobs plain cotton t-shirt in Liberty. It was three hundred pounds. Difficult to justify.

I completely agree Paul, and I’m not attempting to justify it. As I’ve pointed out, the cost of production is the minority of anyone’s costs. And an even smaller proportion of the costs of the brands you mention. They do spend a lot of money though – on things you would consider pointless and wasteful, such as rounds and rounds of designs and changes on new collections.

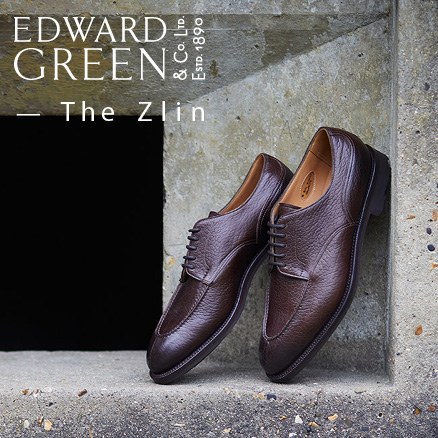

Hi Simon, does your theory hold good for the EG sale, where £650 shoes are reduced to less than £400? You seem to be saying that they are out of pocket with that level of reduction.

They are not making any profit, no. But as I said in one of the ‘PS’ points, profit isn’t everything. They have already paid to make the shoes, and therefore stand to make a much bigger loss if they don’t sell them. It’s still £400 they wouldn’t make otherwise.

One of the trickiest things about managing a clothing brand is managing production and sales accurately. You only want to make as much as you sell, but of course you don’t want to run out of stock either, so there is always excess. This cost of carry with stock is a constant problem. Sales are often a great way for brands to generate quick cash flow and clear stock.

“At the high end of the market, a higher price can add to a product’s allure, according to one economic theory. But the practice is seen by critics as a flimsy platform on which to build sales growth, one that already could be reaching its limit and might prove precarious if the economy sours.”

Thanks Hilary – yes that’s an interesting marketing point, though not really related to my points about cost and profit margin.

There is certainly a client out there that responds more to a high price. I’ve actually been in Harrod’s when an Arab gentleman came in and asked the shop assistant what they most expensive thing they sold was… and then bought it with no more questions asked.

Hi Simon,

A very interesting post.

John

As someone of limited means and still on the very lower rungs of the ‘Permanent Style’ ladder i’ve found some of the most informative and persuasive articles from yourself this year have been around the cost and profit margins .

One of the most important considerations for any buyer of any product is to know that they are not being ‘ripped off’ and by this I think most of us want to know that they are not victims of blatant profiteering.

However based on on what you are saying this is not often the case and that ‘branded’ suppliers are only guilty of using us to oil the wheels of their grandiose marketing campaigns.

It takes quite a while to accept that for example a £1000 suit from a well known brand will have less direct costs of workmanship then a £1000 suit from a bespoke tailor.

And furthermore that the latter will last longer then the former.

Think it would help if a future article took two items of clothing and broke down the costs (direct and indirect) so that we all know what it is we’re truly paying for.

Thanks Rabster, good idea.

The only issue is that things get very complicated with individual items – e.g. the profit margin is an average one across a brand’s output, but can vary a lot between items (typically, items like perfume, sunglasses and other accessories have the highest margins, as well as branded T-shirts etc). That shouldn’t stop us however – we’d just need a fair few caveats.

I think the luxury market is lucrative due to the information asymmetry. The rather unfortunate fact is that most people can’t tell apart the artisan products from the fake artisans goods. Our shopping malls are littered with ‘handmade Italian shoes’ with a fancy name. A selected few brands in the high-end indeed deliver exceptional quality and artisanship to match. Yet this opens the flood gates for the ‘pretenders’.

If you can buy a pair of shoes from Gaziano & Girling for 1000 euros, off-the-rack, it sets an example. If I will create the right story, copy a few selected models and sell them at 499 euros (discounted from a generous MSRP of 699 euros), next to G&G, I’m bound to steal some of the business that would’ve come their way. In addition, one might feel he’s getting a bargain in the process, after all, the pair he’s buying looks very much like that of G&G’s with a fraction of the price!

Customers today are disillusioned by the goods provided by the highly advertising fashion brands that exceedingly seek to position themselves as ‘artisan’ and ‘bespoke’. The costs of goods sold at Prada is less than 30% on average. This gives plenty of room for the pretenders to operate and new business models to take root (http://www.scarosso.com).

Materials and manufacturing have also much improved. The showroom quality of £200 shoes can rival G&G. The leather is polished spotless, construction seems solid. Yet it might fall apart before next season with colour faded and the toe box construction having introduced odd wrinkles.

The trouble is:

Quality is hard to determine,

Consumers are disillusioned due to fashion brands,

The lasting quality is few and far between,

There is plenty of stupid money to go around

I humbly ask you to detail the differences between a $6000 cardigan and a £350 one.

Loro Piana: http://www.bergdorfgoodman.com/Loro-Piana-Reversible-Shawl-Collar-Cardigan/prod107310002_cat366201__/p.prod?icid=&searchType=EndecaDrivenCat&rte=%252Fcategory.service%253FitemId%253Dcat366201%2526pageSize%253D30%2526No%253D0%2526Ns%253DPCS_SORT%2526refinements%253D73700049%252C&eItemId=prod105270138&cmCat=product

Anderson Shepphard: http://shop.anderson-sheppard.co.uk/cashmere-5-button-cardigan-37995

Thanks Anders. Hopefully this site helps a little with that information asymmetry.

And if we are all disillusioned enough, it should become uneconomic for brands to just spend on marketing. Only a few companies can live on high-spending billionaires alone.

I don’t have the details on the Loro Piana and A&S comparison, but it’s fairly simple to break down in terms of costs. Loro Piana is actually a brand I respect a lot for the quality of their production. I’ve visited their facilities, I know management and staff there, and they product unquestionably the finest products in the world. But they also spend a lot on things like marketing, staff and stores. A manager in one store told me they make, on average, two sales a day. Imagine how much the items have to cost to cover the store rental and staff salaries for that day.

Hi Simon,

I have to be careful what I say here but I have been told by several high up owners of luxury brands that they now aim to top the new middle market that has grown up over the last few years by making as much profit as they did by selling and manufacturing less. This is the main reason why the cost of luxury goods has increased so much.

Thanks Hillary, that’s not in line with what the people I know at luxury brands say, but it may be true.

I’m told that the biggest reason for the increase in prices is that more brands are targeting the luxury market (given those higher margins, and the way it has performed through global recession). They are both increasing prices as a result – because it does indeed make the product more attractive to some consumers – but also increasing costs, by launching bigger flagship shops (easy to see around London, but much more prominent in China) and spending more on advertising, celebrities, campaigns, social media etc.

Thanks for your comments.

I understand what you say but the companies I am talking about already had the infrastructure in place. They made have opened in China and Russia but that has been planned and budgeted for some time. This is pure deriferenciation. There are now far more very rich people in the world than there was. A very similar thing has happened with some hotels and resorts, they are now so expensive that ordinary mortals cannot possibly go there. It’s a way of ensuring that your fellow guests are similarly wealthy as you!

True. Pure exclusivity seems to now mean more than the quality itself.

Simon, I’m sure you’d agree that there’s a point where the retailer is overcharging you. If the item that you’re buying is better than the competition then it should cost more. If it’s unique, likewise. Some designer goods are beautifully designed, well-made and justify the price.

I like nice things but I’ve never bought anything from Hermes. A Birkin handbag costs over £5000, I understand. It features some nice hand-stitching. This is a tiny fraction of the hand-stitching that goes into a bespoke suit (£4000 average in Savile Row). Is that over-priced or are the tailors selling themselves short? Interested to know what you think?

Hey Paul,

– Bespoke tailors are a case apart, as explained on my previous post. They have unusually high production costs.

– On whether someone is overcharging you, it depends by what you mean by ‘better’. Many consumers out there (not us, but many nonetheless) are happy to pay to buy into a brand that has been advertised a lot, or seen as an ‘It’ accessory. They feel they are part of something, and they are basically paying for advertising, rather than manufacturing. I think they’re wrong, but my central point is that we should look at a brand’s costs, what it spends money on, rather than its profits.

– I have a soft spot for Hermes. Yes, their things are very expensive, but they also maintain crafts that no other luxury brand does. I’d be more annoyed at someone like Vuitton, that sells very expensive bags and totes that are made of plastic-covered canvas and have no hand-stitching in them at all.

Fair point, Simon. I can’t fault Hermes on quality. Yes, the marketing costs, etc, make up the difference in price. The more astute buyer may choose not to pay for that. However, that’s luxury for you. Sometimes our heart overules our head!

Very interesting. Is it right to say that where a brand is sold through a third party stockist (e.g. a department store), it’s generally the store who takes the risk if items don’t sell until a sale at a cut price? I noticed on Christmas Eve – as has happened for a few years now – Selfridges selling Charvet ties reduced from approx 165 to 59. I suppose that just represents the department store taking a big hit, rather than Charvet initially setting the RRP to include a super fat profit margin?

On a separate note, I have noticed how Hilditch and Key’s shirt prices have risen steadily these last few years. I’m sure they were £95 each three to four years ago. They were approx £120 earlier this summer and now, as part of a soft rebrand it seems (including a new website) the shirts are £155. A 70% price rise in 3-4 years is steep, but if it’s been done to keep profit margins at a sensibly healthy level (in the face of rising cotton prices, wage inflation, increased retail rent), then fair dos. But that’s approaching what you’d expect to pay for an MTM Budd shirt or likewise.

On department stores, yes. The standard mark-up from a wholesaler (Charvet here) to retail (Selfridges) is 2.8, so Selfridges sells for 2.8x the price they get it from Charvet.

I can’t say on Hilditch & Key, but they do have a lovely new store. The previous set-up was terrible, and Steven there has done a great job. But price rises were probably inevitable as a result.

I certainly agree as it relates to manufactured items, such as fine clothing, furniture, and jewelry.

However Jancis Robinson in the FT, has several times pointed out that the non-capital manufacturing costs between a 100 pound bottle of wine, and an 8 pound bottle are negligible, relative to the final retail price.

Most surprisingly, were the cost of grapes – very little difference at all (within an appellation/region)

Perception of value is also important.

Some years ago, in my office, we were comparing sporting vices. Someone had just spent the price of a reasonable used car on a windsurfing board. When the conversation had come around to me, I mentioned my recent acquisition of an Italian road bike, investment cast lugs, full top end Campagnolo gruppo, etc.

The windsurfing fellow, could not understand the value of an item that even had engraved seat post lugs, while I could not understand how something that was essentially a slab of shaped foam with a sheet of nylon attached to it could cost more than an item with hundreds of intricate precision parts (many in expensive alloys) hand assembled in Italy by craftsmen..

What the market will bear…

Simon,

Another very informative post. I have had an insight into a luxury brand and have seen how complex and tricky managing costs can be.

Then again, that applies to most businesses!

What sets a lot of the brands you champion apart is the passion that goes with the creation of the product and business. Hopefully consumers will appreciate that and understand why, on most occasions, these products cost a little, or a lot more than other maybe mass produced products.

With regard to high end bags from Chanel etc, do you think the annual price increases really relate to leather and production costs or to test the market and try and keep the brand exclusive? From personal experience the actual retail experience in such stores (as opposed to department store concessions) is generally very well managed and impressive, which must add to the overheads.

Matthew

Hello Simon,

your article did not changed my mind that the brands are ripping us off.

Because for me, to pay more than 50% for advertisement, cat-walks, shiny shops and army of salespeople is nothing else than a rip-off.

I want to buy a piece of clothing. I do not want to pay the bills for the marble.

Seriously – instead of buying a luxury brand 6000 EUR suit, I could get a bespoke suit for 3000 and use the rest 3000 to order a personal catwalk show.

I am sure that you can hire a fashion model for 500 to 1000 EUR a day(strictly catwalk only). 1000 EUR for a photographer incl. rent for equipment. And 1000 EUR for a small location. And voila -> a personal catwalk show live. 🙂

To be honest, the whole fault for this brand rip-off are the people themselves. People are no longer capable to judge the quality and buy clothes more because of brands and marketing and not because of quality.

Just have a look at the omnipresent polyester in the mass public brands. It seems that people do not care that much about the fabric and as a result the fashion business uses polyester excessively. If 90 out of 100 customers ask for natural fibre clothes, brands would stop using polyester. But this is obviously not the case at the moment.

Same is with marketing. People buy more from brands that spend more for marketing forcing the whole market to spend more for marketing.

If it was the opposite then, the fashion business would invest more in quality and less in marketing.

With a growing middle class, the percentage of discriminating customers goes down.

While a profit margin of 20% is not unreasonable I can’t help but to think some manufacturers use their brand name to make a lot of money on some items that are inexpensive to produce, but still carry the brand name. For instance Hermes. In Oslo (capital of Norway, for those who are geographically challenged) their store sell t-shirts, they look Nice, but at 750 pounds a piece, yes, sevenhoundredandfiftypounds! You’d feel like an idiot buing one.

And let us not forget the brand name sunglasses designed and prodused at the Luxotica factory, I would not be surprised if some of them have a margin of several 100%.

Hey Willy,

As mentioned in reply to another comment, some items such as sunglasses do have a larger profit margin, but it’s not that much bigger than the 20%. It costs a lot to convince guys to buy them!

Simon

Yes, I suppose when you factor in the 100’s of millions paid to the Beckhams and some Hollywood stars, the cost of three flimsy bits of plastic and two tiny screwes can escalate monstrously. I still feel a bit insulted by the 750 pound t-shirt however. Hermes makes a lot of beautiful products put together by artisans. But that t-shirt……

Good article Simon and great comments. I`ve previously commented here about markup and wish to make two points. Firstly, amongst luxury brands in general there has been massive conglomeration across the fashion industry across the last decade. A quick check into the operations of LMVH, Kerring and Richemont will support this, especially in the area of timepieces. This conglomeration provides economies of scale and subsequent cost reduction. Connected to this has been the general trend across Corporations since 2003/4 to drive down costs (read reduce staff numbers/outsource/export manufacturing). The outcome of these changes has been cost reduction but price increase with subsequent increase in year on year profit figures. Secondly, having tracked retail prices across certain items over the last few years, it seems clear that we also have to take into account the conveyor belt of sales periods that impact on total sales. Hilary`s post outlines this in splendid detail wherein price rises are well above inflation and the possible contribution of supply chain cost increases. The core strategy is to release high with an expectation of reduction in pre-Christmas, Black Friday, late Christmas, New Year, End of Season (etc. etc.) sales. Therefore new season offering prices are initially pitched high to the consumer, then reduced at mid-season, particularly in Online offerings (20% is normal) with final reductions going to 40-70%. Consumers, better informed than ever, are altering their buying habits due to Online sales whilst Markets are also undergoing massive change as data led management techniques and Online retailing converge to produce new opportunities for consumers (the Inditex model is king here though many luxury brands have taken note). For consumers, driven by fasion and season, being on the cusp of value v. availability is key. For example, Jaeger, in rebooting the brand have become very adept in constantly modifying a range of Online offerings to its loyalty cardholders whilst maintaining yearly price increases. One final point, we live (thanks to Chinese manufacturing) in an age of oversupply, which we should enjoy whilst we can, Auto manufacturers have already woken up to stock reduction techniques in an effort to maintain not price but market value – at some stage this may be applied to fashion (I believe this has already begun in the high end aspect of the fashion market). This will be exacerbated by the possible introduction of future trade block deals that are under current discussion (for example TTIP) which may reduce China`s manufacturing and export access to global markets, with subsequent impact on supply and price models.

Many high end retailers now no longer hold season sales as well as having significantly increased their prices above the addition costs of store openings and marketing. This is to prevent the product now failing in the hands of people that cannot afford to pay full retail prices

Going back to Hillary’s last comment, it is clear a number of the more obvious / well known labels have the issue Burberry had a number of years ago, with the house check becoming associated with, well there is a simple word for it (and I live in Essex so I guess I am qualified to use it) – chavs. It is clear that some young people will spend what must be all of their disposable income / credit limit / 18th birthday presents on Chanel or LV bags, which presents a dilemma to the companies concerned. They are capturing these new clients at an early age, before they have responsibilities (mortgage, kids etc) and the costs that go with them but the companies risk alienating those that desire or choose to buy these goods later in life.

Returning to Ben’s comment about profit, and anything above 0% being a rip off, I agree the craftsmen should be paid fairly but unless the business owner, who often takes considerable personal financial risk in running a business makes a profit (or at least aims to do so) what is the point in being in business? Altruism doesn’t pay the bills… (I am not referring to the luxury conglomerates and it may be that Ben was referring to them).

Matthew

Hi Simon,

I was actually thinking of your friends “ripping off” comment the other day whilst suit shopping. I actually to my disbelief found myself agreeing with him, but rather at the lower end of the market – Especially the High Street.

I will explain. I was in the market for a new RTW suit. I don’t wear often so around, so invest most of my cash in G&G’s! So my budget for a suit was £4-500 including alterations. After looking and trying on 15,000 suits I found a very nice Polo Ralph Lauren suit for £445 (I am going to leave sale prices out of this) The salesman was not sure who the fabric was by on this particular model however suspected it was VB Canonico. The fit was a bit off so walked across the street to suit supply. Found another lovely suit similar construction also made in some far off land to a good standard (like the RL) for £350 in similar quality cloth also by Cononico. I bought it. Very happy. They also did another suit in another VBC cloth, slight cheaper quality for £250. Now I am not stupid, I understand why the difference in cost between SS and RL. RL has a huge marketing budget, excellent aftersales, and maybe marginally better lining, button etc. (and much bigger rent on Bond Street)

But where I felt the rip off was actually when my girlfriend was looking at the NEXT catalogue. They now have a VBC clothed suit for £300! I doubt the quality of cloth is any better than the RL or the SSupply suit I bought. Probably more in line with the cheaper £250 Suit supply suit. The fit maybe terrible but that can be subjective. This is also a fused, poorly made suit with terrible lining. To me this is vastly overpriced. Yes a nice cloth, but not a quality product. So therefore in my opinion we are ripped off sometimes, but it’s actually on the High Street.

Also along these lines, it is nice that the high street is upping their suit and separate game a little but they seem focused on cloths and not the fit, or construction. Next and M&S are proud of their cloths from VBC as mentioned, Cerruti, Reda, Tollengo and some others. However what is the point of upping the cloth quality and price but still gluing your suits together and giving them poor usually baggy fits.

Very interesting point Adam.

As I’ve spelled out previously, by the way, I don’t think people should be buying on the basis of cloth labels. They don’t denote much difference in quality – and if people didn’t it would avoid that problem with NEXT as well!

Of course however was good to point it out in this case to explain my point.

Absolutely. Thanks

Nothing to disagree with there, however I know M&S have done a lot of work on improving their patterns in the past 2 years. They now offer 4 different patterns across their suits and jackets, and there has a been a real drive to improve fit. It’s still high street RTW, but they are making steps.

I think the issue here is that you are confusing corporate level profit margins with profit margins on individual items. Given all the expenses above costs of production which you rightly outline (branding, etc), the margin on an individual item must be above the the company’s overall margin as reported in its financials.

Another important disctintion is between “luxury” companies. There are on the one hand, the luxury comglomerates (LVMH et al) and the much smaller, independently or smaller investor owned (individual bespoke tailors, many of the smaller shoemakers you profile). The former spends a vastly larger percentage of their costs on marketing, real estate, etc and the latter a vastly larger percentage on materials and labor.

Thanks Ben. I don’t think I was confusing the two types of profit – I was deliberately building corporate expenditure into calculations per item.

Bespoke tailors and shoemakers are also a breed apart, and shouldn’t be considered in the same way. Their production costs are vastly different (as spelled out in that previous post – have you read it?).

More interesting is comparing different retailers. Those that survive selling to the same customers, for example, as an LVMH company but manage to spend more on production and quality.

Got it. Did not realize you were building in those additional costs. Thanks for the clarification.

Yes, read and liked the previous post a lot. I don’t think you’re conflating the two very different business models, more that readers might not know you were implicitly making that distinction.

If you are adding in marketing and real estate in those cost/profit margin numbers, I guess my point is that the customer is right to wonder what they are paying for. With bespoke, as your post points out, it’s mainly materials and labor. With luxury conglomerates, “cost” includes other things and I think that is the underlying issue people have when the question the price of branded luxury goods.

If you want the branding, it’s worth it. If you don’t, it isn’t. And that, paradoxically, is why luxury companies keep spending on branding. Without it, the value their core customer seeks vanishes.

Exactly. Although, it’s interesting that even on a Savile Row suit, only 33% of the costs are production. The making of the thing is never most of what you pay for.

On what basis are you making these profit claims?

Not that I really doubt them, though I do find your assessment problematic.

“But 20% isn’t that high.” Such comparative statements are meaningless without context. Sure, 20% isn’t high compared, with, say, the 35% – 45% margins Apple gets. But they’re huge compared to, say, Zara’s 5% average.

Plus, telling consumers that they’re paying for advertisement is not going to much allay the feeling of being ripped off.

The fact of the matter is, as long as they can do so to gain higher profits, luxury makers are going to raise prices. For me, as a consumer, as long as “costs” entails paying the tailors the craftsman’s wage they deserve, anything above 0% profit constitutes a rip-off.

Hey Ben,

– Profit numbers are based on conversations with people in the industry over the past five years, and specifically four people for this article, from both start-ups and international companies (including one LVMH company)

– My point on 20% was that it isn’t high compared to the 80% my friend assumed the profit was on a pair of boots, as hopefully the piece made clear

– It is in this sense that consumers aren’t being ripped off. It’s not all going to the bottom line, but being spent on other things. As I said, the point is that these costs are not what we would approve of. Focus on the costs, not the profits

– What luxury companies can get away with is another interesting question. Competition has a lot to do with it, and there is a lot of herd mentality, both around what prices should be and what money should be spent on (and that herd mentality has hugely driven up rental prices in major cities)

I deliberately avoid brands that have an obvious high marketing spend – I want to pay for the quality of the product and not the marketing campaign. My suits and formal shirts are tailor made (in Asia when I lived there and previously a tailor in the East End who sadly has ceased trading). What brands do you recommend as particular value for quality (as opposed to just cheap)? I visited the John Smedley factory in June and came away a very happy shopper.

I think there is some confusion in there comments as people seem to misinterpret what Simon is saying, or at least people are talking about two different things:

1) Value for money in terms of quality of product

2) Amount of profit a company makes (gross profit vs net profit)

In fact the two are totally unrelated. A company that makes little profit doesn’t mean they make great value products.

Luxury products have huge gross profit margins, but essentially they net very little due to things that Simon says; prime retail locations, the very best branding,advertising,packaging etc, how much do you value these things? (Alot intangible)

And thus I think the objective of most people here is value for money, and are somewhat more informed, it makes more sense for said people to perhaps find smaller brands/craftsmen who produce in line with their own expectations and standards, who have less gross margin between cost of goods and sale price, as they will in simple terms be getting better value for money (in a tangible sense).

TLDR People care about gross margins, Simon is talking about net margins

I would like to know the source that confirms the stated profit margins because these are not what I have experience with… , e.g HERMES’ operating margin for 2013 was a whooping 32.4% !

The consumer only cares about the difference between the manufacturing cost (materials + labor) and the selling price minus VAT, i.t. the gross profit. This is what defines the product’s profit margin. When you factor in the operating costs of the company, you are talking about the company’s net profits, not about the product’s gross profit. Consumers do not care if the company has high operating costs; this is the company’s problem. What a regular consumer cares about is whether the product he/she bought has a good value, e.g.

Manufacturing Cost: 300 euros

Wholesale price: 500 euros

Retailer’s price: 1000 euros

Vat: 200 euros

Price: 1200 euros

So, I am paying 1200 euros for a product with a manufacturing cost of 300 euros. Of course I will find this a rip off. With a 40% sale, the product price will drop to 720 Euros. Let’s look at the profits now:

720 – 20% VAT = 600 euros

Manufacturing cost: 300 euros

Wholesale price: 500 euros

Retailer’s profit: 100 euros

So, the retailer is STILL making a profit. In some cases, the retailer makes more profit if they have an agreement with the manufacturer to absorb some of the sale.

Your last point is right.

On Hermes, I dont have a number but my point stands even on a 30% profit – its not as big as the 60-80% people think it is. And some other industries often have similar or even bigger net profits.

On operating costs, thats a much bigger point. I broadly agree manufacturing is the most important thing, but how about design? How about the wasted prototypes involved in getting a new design right? How about educated and useful sales staff? Or good returns policies?

Perhaps more importantly, how about the uncertainties of producing and selling product? A straight calculation assumes a brand sells everything they make. That never happens.

I agree with you here, you have to take into account that they may never sell all the items they produce and still have to make a profit, if not, it would be the end of business. Design and a plethora of costly prototypes cost money as well, and those are expensive and necessary to get things just right. If you try to make your own “hermes thingy” at 300 pounds, good luck getting at the right design and quality in the first attempt.

Exactly. That’s the side of the business people never see – and their expectations that nothing should go into design etc is what drives business models like Zara and Primark

Simon, if a luxury manufacturer refers to volume of sleeve units, does this mean number of suits?

Suits and jackets, yes

I think Pricing is a strange thing. I’m sure I read an interview with Brunello Cuccinelli and he said the mark up is 8 times for his products. I’m fairly certain I read it correctly because I was shocked to read him openly say what the mark up is. At the same time I found a Brioni shirt in Bicester reduced from £380 to £38. It was a size 17 neck and the last one. An odd size and last one so reduced significantly…..significantly enough that I’m sure it was loss making although being Bicester, if the rumours are true, clothing is specifically made to sell at lower prices there, so no actual discount really. Pricing is strange.

Much.of it is, yes.

Remember, though, that the company has already paid to produce the piece of clothing. So even if they’re making a loss, it’s better than losing 100% on it

Considering Tom Ford,

– when the sales move from -30% to -50% they do not recover all their costs?

– do they not make average margins on suits and shirts but huge ones on sun glasses and perfumes? Same for RL, Dior, Armani,… is clothing there not mainly to build the image as Haute couture does for Dior ?

– No, they don’t. But bear in mind that they’ve paid for the clothes already. So if they don’t sell them, they lose a lot of money. It’s about avoiding losing money as much as making it.

– Yes, absolutely. Much bigger margins on sunglasses, perfumes and cheaper items, eg T-shirts

Burberry’s profit margins were 70.1% in 2016! they’re luxury clothing

Could you provide more information on the breakdown of that, or the source? Thank you

I know of a brand in Australia who’s profit margin is around 80% (inclusive of taxes and costs). for example, the pair of pants they sell for $100 only cost the brand $5-10 to make.

I doubt that includes all their costs. What do they spend on staff, rent, marketing, sales, wastage, product development, advertising, administration etc?

This happens a lot with staff that work in stores. They get a 70% discount or similar and are told the company is still making money on the product. They’re not overall – those kind of brands often spend a lot on marketing, design, retail and so on. If companies made those kind of margins with any ease, they would be competed away.

Hello,

So if I plan to start a shoe store and stock shoes which retail at 1000£ a pair, then what would be the actual profit which I can make on that single pair keeping in view the store costs, staff and marketing.??

Thank you.

It depends a lot on things like where you are, and therefore the rent Umair. I’d work the other way – see what the wholesale cost is for your shoes, and then add up all your other costs, and aim for perhaps a 20% absolute profit on top

Hi Simon,

I think when people talk about being ‘ripped off’ by luxury brands they are less concerned with the net margins and more talking about operating margins. This is where people feel ripped off.

E.g. a Savile Row suit may have an operating margin of 60%, which feels reasonable. You’re paying £4000 for something that costs £1600 in direct material and labour costs. When you instead pay £3000 for a coat from a luxury RTW brand that has an operating margin of 85%, you’re paying for £450 in direct material and labour costs.

The Savile Row suit feels better value, because more of the money you spend is going directly to the product you will own. I understand that the marketing expense, retail locations etc. benefit me as a consumer as well, but it’s nice seeing your pounds going directly to the item you will own.

Hi,

I can definitely see that, and in general I support it.

But it’s also worth bearing in mind that many of those other things that are not material and labour costs, add value, and are often underestimated.

For example (for me) one of the big failings of traditional tailors is their lack of design. It’s what makes them look old-fashioned, and puts off young people visiting them. In the end, it’s the thing that will kill off bespoke before anything else. Newer bespoke tailors succeed in that area very quickly – see The Anthology or Prologue for instance. Savile Row tailors should spend more money here.

They should also spend money producing show garments every season, to give new customers something to try on, and existing customers ideas of new commissions. It’s a big thing that puts off younger people when they first visit.

They should also spend a little money on low-level marketing, such as social media imagery of their finished garments – see what Japanese shoemakers do with their shoes, for instance. It creates a huge amount of interest.

Then there’s paying good wages to salespeople and cutters, having a convenient and attractive retail location, travelling frequently and so on, as you mention.

Big brands should spend a lot more money on their actual product. But small craftsmen should also spend more money on some of the things that brands spend on. And when consumers spend their time just trying to find value in the product itself (eg going straight to manufacturers, or online brands) they undermine the ability of craftsmen to do so.

Your point about often poor or old fashioned design by bespoke tailors is so true. Companies such a Zegna and Belvest for example spend a lot of time and money on model design annually. The bespoke houses should learn a lesson from them in this regard. Probably my favorite models that I’ve seen on you are from Ciardi, Steven Hitchcock, and Nicholetta Caraceni.

You understand nothing about accountability.

I have two fashion brand with over 30 shops.

Markup is the flip we are doing from raw cogs. Classic if you have the factory is 5/6. If not 3/4. Luxury 8. This is the mark up.

The net margin is around the % you said 5% to 30% for luxury good brands.

But we are doing a lot of cash by discounting at 30/50%. Because with the normal price we did pay our fixe cost. And we have higher production to achieve cost of scale and unsure to have all format for all size. The. We are looking to cash in the business with whatever enter. We already pay all cost. It is now the moment to earn real marg. Not théorique marg. And at this end we have a markup at 3. But when price go down, taxe go down and sell goes up, so cost of conversion go down etc. We are not earning 20% of the unit price. But 20% of the whole volume of sell. And this is a big difference.

Dear Simon,

Thank you for this very interesting article.

Do you have any idea about the number of garments (mainly suit) produced in a year by brands such as Tom Ford & Ermenegildo Zegna?

It appears to me that stores/online retailers will only stock 1 – 2 garments of each design in any particular size. If I had to hazard a guess, Tom Ford would probably produce around 15,000 – 20,000 suits in a year?

18,200 garments = 130 stores X 2 seasons X (10 designs X 7 sizes)

I would be glad if you could share any thoughts on this topic.

I don’t know I’m afraid Nicholas, and I’m not sure anyone would outside the company itself. There are lots of shops and wholesale accounts, and often different designs are made for different regions.

Actually I’m doing small research about the mark-ups and other pages claim they are much higher than 20%, e.g. https://makeitbritish.co.uk/opinion/making-clothing-uk-really-expensive/. For sure I know small brands are recommeded to sell the product at the price 4x higher than the production costs.

That’s a useful article, but doesn’t really go into the ways luxury brands spend money at all. The example above of Cucinelli is much more specific and factual, rather than averaging data where you’re not sure where it comes from.

Also, don’t mix up manufacturing costs and wholesale costs. If you are the manufacturer, then you may well be selling at 4x the cost of manufacture.

Sorry, it was a silly comment, as a non-native I mixed up a mark-up and a profit margin, shame on me ;P thanks for the remark, I took a look at the Cucinelli example; I guess no high street brand publishes such a calculation and generally it’s not common in the whole industry

It is quite common actually – most public companies will publish something similar

To be honest I think this piece does a bit too much hand waving. Luxury margins might be lower than we think in net profit, but that is precisely because of all the things you included in the cost section. If I were to buy something from Hermes, I would be paying for their super luxurious shops in China, their top executives’ pay which is probably several times my own,

professionals specifically hired to manipulate the market (it is common knowledge they do this) so that their product value stays at the inflated prices they need to protect exclusivity, and all kinds of stuff which I have no interest to pay for, first and foremost. Including this all in “cost” is a bit hiding the problem by reformulating the premises imo.

Thanks And. I agree, but that’s precisely my point.

When people talk about luxury brands, they don’t say this. They say they must be making massive profits. And they’re not necessarily – it’s about what they spend their money on.

Also, a lesser point is that some of those things they spend money on (not all) are things I don’t mind paying for. This includes a great design team, good customer service, and lovely stores. If I buy just from a factory, I get none of that, and people would miss those things if they went, even if they don’t realise it.

The sweet spot is somewhere in between, for me, where you pay for those things, but not the executives, the advertising, and everything else you mention. That’s what you get with some of the brands we cover, like for example Connolly or Anderson & Sheppard.

How much do Personal Shopper charges Admin fees?